Action required for tax form 1099 filers

Effective for tax year 2020, the IRS has changed guidelines for reporting non-employee compensation on form 1099. The government has brought back form 1099-NEC to report non-employee compensation. If you need to file both the 1099-NEC and the 1099-MISC, you may need to update your chart of accounts in QuickBooks. Please review this post for detailed steps you must complete prior to completing 1099 forms for tax year 2020.

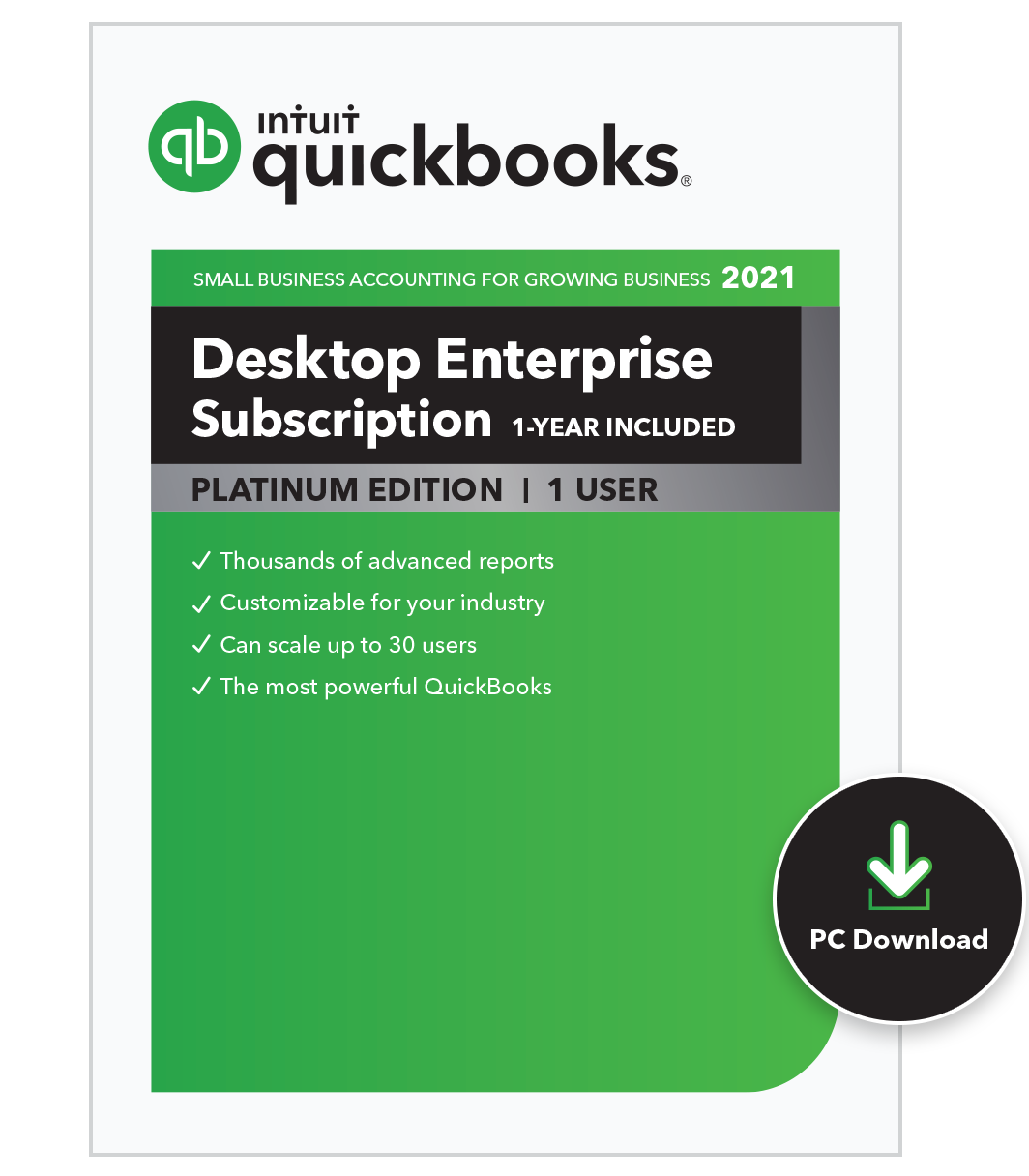

See what's new in QuickBooks 2021

QuickBooks 2021 is here. QuickBooks Desktop 2021 brings both new and improved features to help you get paid faster, while making the data your employees see more effective for their role in your company.

A little bit of QuickBooks training builds efficiency; saves time, money

Training results in good things for your business. Just ask the senior accountant at FirstWatch Solutions. "Peak Advisers assisted my company in fully utilizing QB Enterprise. We experienced immediate improvements in the functioning and speed of our file after our very first session.”

Customized solution success: Spend more time analyzing data, less time obtaining it

Peak Advisers works with many outstanding organizations to implement systems specifically designed for their needs. We help make their businesses operate more efficiently, saving both time and money. In the case of Esler Companies, they are now able to spend more time analyzing data, and less time obtaining it. (Esler Companies employees photo courtesy Esler Companies)

Guide to restarting your business in the new COVID-19 world

Things are not the same as a result of the COVID-19 pandemic. Even as we’re able to restart businesses, our ways of operating have changed … some of the changes are brand new and permanent.

Colorado sales tax return deadline May 20 for March, April and Q1 2020

The sales tax return deadline for March, April and Q1 2020 is fast approaching in Colorado. It’s May 20, 2020. Here is the information from the Taxation Division of the Colorado Department of Revenue.