How Intuit's Agentic AI is Changing Business Automation

Intuit’s Agentic AI is transforming business automation. From reducing manual tasks to delivering real-time insights, learn how this AI technology can help your business grow.

Preventing accounts payable fraud: A guide for business owners & accounting managers

Discover essential strategies for preventing accounts payable (AP) fraud in our comprehensive guide. Learn about AP fraud vulnerabilities, the impact during crises, best practices for risk reduction, and the role of AP automation in enhancing efficiency and security. Ideal for business owners and accounting managers aiming to protect their finances and reputation.

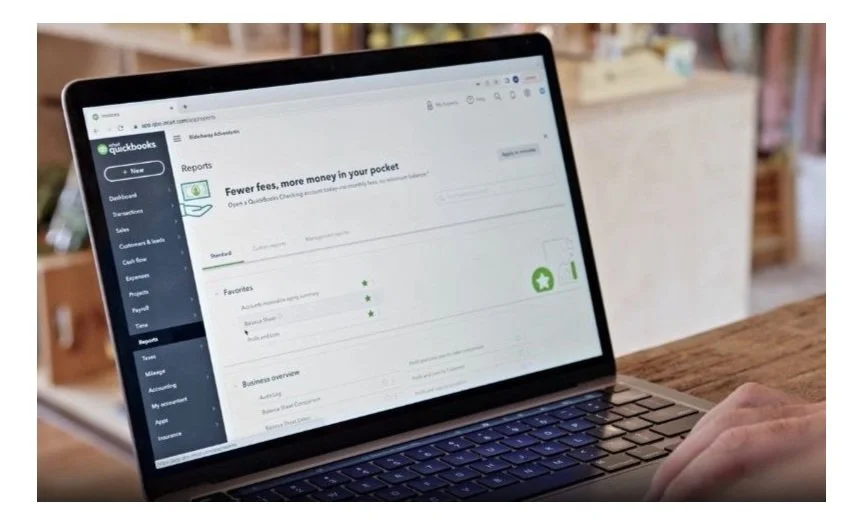

10 things QuickBooks Online does to help run your business better

QuickBooks Online has become a powerful tool that business owners can rely on to be the hub of the financial side of their operations.

Use QuickBooks to automate time-consuming tasks

Peak Advisers frequently addresses automation and how QuickBooks Desktop and QuickBooks Online can help you reduce manual labor inputs in our blogs and newsletters. Sometimes it takes short-term pain to enjoy the long-term gain.

See how automation and QuickBooks make your business run better

Peak Advisers is honored to work with great companies like Webster Associates of Denver, Colorado on projects related to automating financial management systems and improving workflow and growth with applications that make sense.

Peak Advisers automation service saves global company 5,700 hours

Eteam’s global CFO, Jagadesan Balakrishnan talks about his business, the time consuming data entry issues they faced and how Peak Advisers created and implemented an automated solution that saves the worldwide company impressive time and money.