How Intuit's Agentic AI is Changing Business Automation

Intuit’s Agentic AI is transforming business automation. From reducing manual tasks to delivering real-time insights, learn how this AI technology can help your business grow.

Streamlining Construction Project Management and Job Costing with Intuit Enterprise Suite

Managing construction projects and job costing is easier with Intuit Enterprise Suite. Learn how real-time insights and automated workflows can boost your profitability.

Employee Handbooks: Simplified for Businesses with QuickBooks Payroll HR

Discover why every business needs an employee handbook and how QuickBooks Payroll, with HR support, can simplify your HR tasks. Let Peak Advisers guide you in building a strong foundation for your team—read more to find out how!

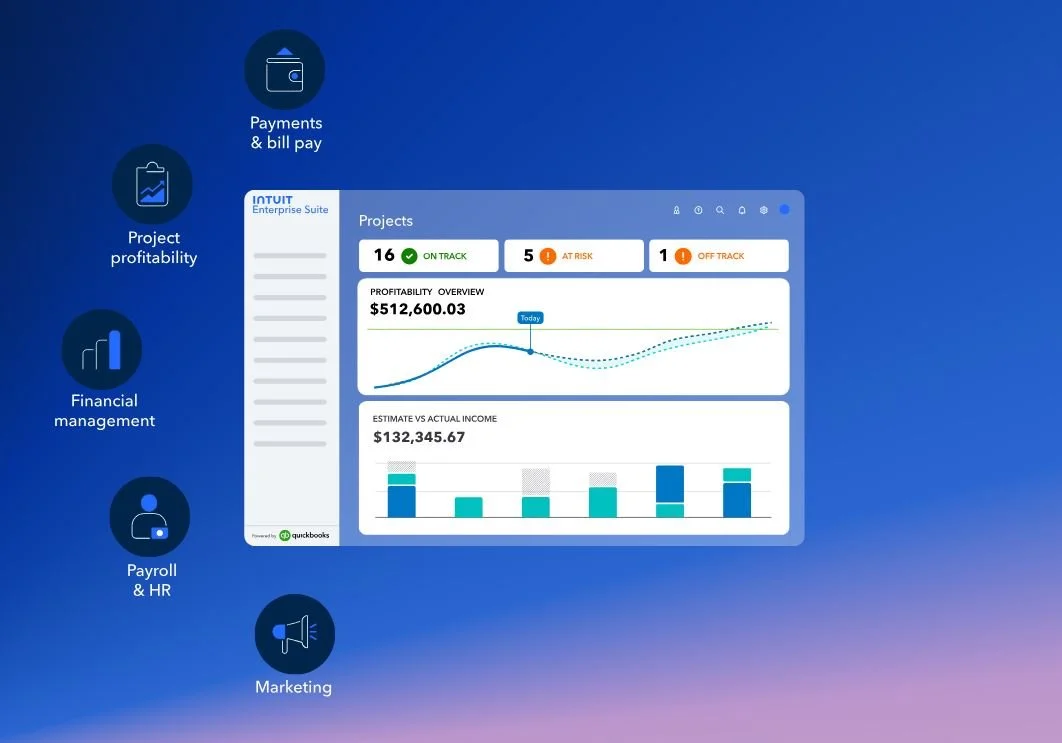

Intuit Enterprise Suite: The Ultimate Tool for Business Growth and Managing Complexity

Intuit Enterprise Suite empowers your business to scale with ease, offering real-time insights, streamlined operations, and integrated marketing—all in one powerful platform.

Defend your business against phishing attacks

Protect your business from costly phishing attacks with practical tips on prevention, detection, and what to do if you're targeted. Stay safe and secure—read the full guide now!

ServiceM8: The Ultimate Tool to Streamline Your Service Business and Boost Profits

Boost your service business efficiency with ServiceM8—streamline scheduling, invoicing, and quoting all in one powerful tool. Discover why ServiceM8 is the top choice for service businesses looking to save time and increase profitability.